Table of Content

- VA Loans & Credit Flexibility

- For service members

- Largest Retiree & Veteran COLA Increase In Decades Approved

- How to Lower Your VA Mortgage Payments

- What Is The Minimum Credit Score For Va Loans

- Tips To Improve Your Credit Report Before Home Buying

- How To Apply For Fha Loan In Illinois

- How To Get a VA Loan With Bad Credit

However, if you were to put 10% down on your home, your funding fee would be 1.4%. Veterans that receive a disability rating from the VA don’t have to pay the funding fee. Conventional loans also tend to offer the most competitive interest rates and flexible repayment periods, from 8- to 30-year mortgage terms.

The VA mortgage limit is the maximum amount the Department of Veterans Affairs can provide without any down payment. After getting preapproved, you can move onto the VA loan process and apply for the VA loan Certificate of Eligibility. MPRs or Minimum Property Requirements are certain conditions the VA requires your house to meet to qualify for a VA loan. It is simple to check whether the home is safe for living or not. You are a current/former military member who has either served a minimum of 181 consecutive days during peacetime or a minimum of 90 consecutive days during wartime. VA mortgages were initiated in 1944 by the US Department of Veterans Affairs to help veterans purchase or refinance their homes.

VA Loans & Credit Flexibility

Keep in mind that many sellers find preapproval letters to be necessary as a way to show that you are serious about the offer you've made. People who don't have preapproval letters are oftentimes just “window shopping” and won't actually make a serious offer when it comes time to do so. Before you go searching for a home to buy, it's highly recommended that you obtain preapproval with your preferred lender. By doing so, you'll be able to identify how much you can reasonably afford when buying a home. See how the VA 30-year fixed-rate mortgage has performed recently. He specializes in economics, mortgage qualification and personal finance topics.

Keep in mind, you can qualify for more favorable terms with a higher score. And, one good thing about the VA guarantee is it gives lenders a chance to help more borrowers who may have less-than-perfect histories. Since a VA lender is more protected when funding this type of loan, they are more willing to approve borrowers with low credit scores. That's why there is no official credit requirement, though individual lenders may set a requirement. Different types of lenders —private banks, mortgage companies and credit unions — offer VA home loans. Reach out to multiple lenders to learn about their products, process and customer service.

For service members

These requirements focus on making sure that the property is safe, sanitary, and structurally sound. For instance, the property must be free of any lead-based paint and sufficient in overall size for standard living necessities. If you are an existing service member, veteran, or surviving spouse, you should be able to qualify for this type of loan. Once the right documents are submitted, you'll be able to obtain a Certificate of Eligibility. The exact documents you require depend on your status with the military. Keep in mind, however, that any money you do put down will reduce the loan amount and give the lender more confidence that you'll be able to repay the loan.

Apply online for expert recommendations with real interest rates and payments. Offer down payments as low as 3.5% and low-equity refinances, which allow you to refinance up to 97.75% of your home’s value. Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. And even if you do find a third party worth using to help you fix your credit, this process will take just as much time to resolve as if you were doing it yourself. In cases where there is inaccurate information that needs to go, there is a dispute and resolution process that cannot be hurried.

Largest Retiree & Veteran COLA Increase In Decades Approved

Having no credit score is much different than having a low credit score. A low score means you’ve borrowed money and have done a poor job paying it back. This is a red flag for lenders and makes it more difficult, but not impossible, to secure a mortgage loan. Youll need to raise your credit score if its below 500 or you dont qualify for an FHA loan. Even if you can get a loan right now, there are plenty of benefits to applying for a loan with a higher score.

The Veterans Affairs office can most likely recommend credit counselors and consultants to you, but you can also visit HUD’swebsite directly for help. There are low-credit score loans for borrowers who need them, but it’s preferable for all borrowers to work on their credit in the 12 months leading up to the loan application. If you served for at least 90 days of active duty, you meet the minimum service requirement. If you’ve served for at least 90 days of active duty, you meet the minimum service requirement. Applicants with scores below a lender's standard usually can't be approved for VA financing.

However, these loans have additional requirements compared to VA loans, including a down payment. Most USDA loans are available to borrowers with a credit score of at least 640, but you may be able to qualify with a lower score. The short answer is no, there is currently no minimum credit score required for a VA loan. While the Department of Veterans Affairs doesn’t have a credit score minimum set, mortgage lenders do. Lenders have the ability to set their own credit score minimums depending on what they are comfortable offering. Borrowers can expect to need a credit score of at least 580, but that number can vary from lender to lender.

For every subsequent use, the funding fee is 3.6% of the total loan amount. Enter the expected cost of the house and the amount you are willing to make as a downpayment. However, putting money down upfront would reduce your monthly payments. Making on-time payments regularly shows prospective lenders that you are responsible for your money.

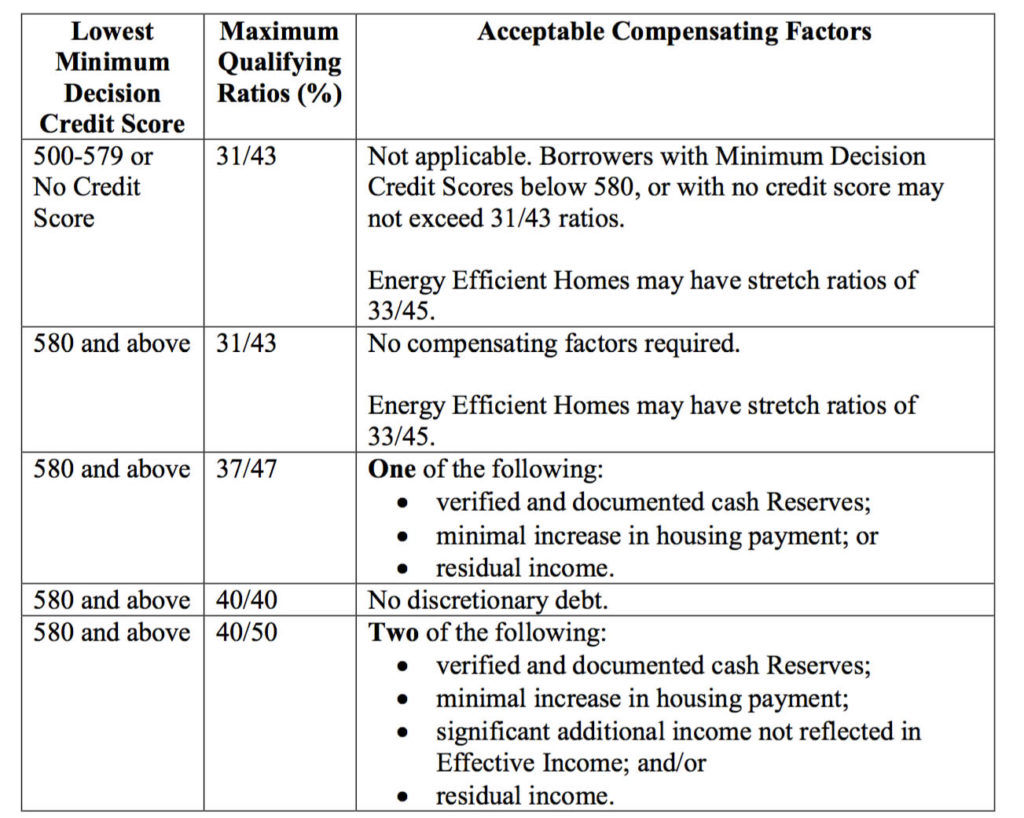

The best way to know the score requirement is to speak with your lender directly. For example, if you put five percent or ten percent down on your VA mortgage, your VA loan funding fee is reduced depending on which amount you pay. The use of compensating factors is an accepted industry practice. Borrowers who make down payments on VA mortgages should know that there are definite benefits to doing so even if you are forced to because of lower FICO scores. Find out if you can get a VA-backed IRRRL to help reduce your monthly payments or make them more stable.

It’s true that you may not see too much variation between those numbers, but in cases where you do, the middle score is one to pay attention to. But VA loans are also more flexible and forgiving than other loan types when it comes to things like bankruptcy, foreclosure and short sales. The site adds that consumers who pay their bills “regularly for at least the last 12 months” are more likely to get a favorable look from a loan officer.

However, the VA loan program’s eased credit standards are one of its most delicate features. It’s a good idea to be aware of all your mortgage options before settling on one. A VA loan isn't the only option for borrowers with bad credit. In fact, FHA loans have lower score qualifications — sometimes as low as 500.

They use data from three credit reporting agencies — Equifax, TransUnion and Experian — to determine credit scores. Two main factors they consider are your payment history and credit utilization. Since jumbo mortgages allow such a high loan amount, lenders can be stricter about their minimum credit score requirements.

No comments:

Post a Comment